COVID-19 (Coronavirus) Information & Business Assistance Programs

Families First Coronavirus Response Act (FFCRA)

FFCRA is helping the United States combat COVID-19 by giving all American businesses with fewer than 500 employees funds to provide employees with paid leave, to allow for the employee’s own health needs or to care for family members. This ensures workers are not forced to choose between their paychecks and public health measures while at the same time reimbursing businesses.

Eligible leave includes 2 weeks per employee of sick leave under the FFCRA and an additional 10 of the 12 weeks of FMLA including the health insurance premiums are refundable via a tax credit.

Guidance is provided in the following documents:

- Fact Sheet for Employees

- Fact Sheet for Employers

- Questions and Answers

- FFCRA Recorded Webinar Slides

- FFCRA Recorded Webinar

Attached below are posters on the FFCRA produced by the Department of Labor (DOL), Hour and Wage Division, as well as guidance notice requirements, and a Field Assistance Bulletin regarding a temporary non-enforcement period to the FFCRA.

WAGE AND HOUR LAUNCHES NEW FFCRA ONLINE TOOL

Wage and Hour launched a new online tool that guides workers through a series of questions to help them determine if they are eligible for paid sick leave or expanded family and medical leave under the Families First Coronavirus Response Act (FFCRA). As America continues to re-open, this tool stands to help employees and employers to determine who is qualified for the FFCRA protections and benefits. Here is the full link: https://www.dol.gov/agencies/whd/ffcra/benefits-eligibility-webtool.

Coronavirus Aid, Relief and Economic Security (CARES) Acts

The CARES Act legislation provides $377 billion in small business aid, defers federal student loan payments through Sept. 30th, and provides $100 billion for hospitals and $200 billion for other “domestic priorities,” including childcare and assistance for seniors.

It also gives a one-time check of $1,200 to Americans who make up to $75,000 ($150,000 for married couples filing jointly). The amount would be reduced for individuals making more than $75,000, zeroing out at $99,000 ($198,000 for married filing jointly). Individual tax filers or married couples would receive an additional $500 for each dependent child 16 years of age or under.

The IRS needs your banking information for direct deposit from your 2018 return. If they do not have your direct deposit information, visit www.irs.gov/getmypayment.

CDC GUIDANCE DOCUMENTS FOR REOPENING

OSHA COVID-19 Guidance for Construction Trades

The US Department of Labor’s Occupational Safety and Health Administration (OSHA) has unveiled a new COVID-19 related guidance specifically for the construction trades. According to OSHA the guidance is intended for construction employers and workers, such as those engaged in carpentry, ironworking, plumbing, electrical, heating/ ventilation/air conditioning, masonry and concrete work, utility construction work, and earthmoving activities.

OSHA PROVIDES NEW GUIDANCE ON SOCIAL DISTANCING AT WORK

The Governor's Economic Re-Opening Task Force continues to hold meetings. The task force is charged with developing a plan and overseeing the state and private-sector actions needed to reopen New Hampshire’s economy and getting people back to work as soon as possible, in a phased approach, while minimizing the adverse impact on public health. The road map for the task force can be found here.

Call-In Information:

Call-in: 1-800-356-8278 or 1-857-444-0744

Pin: 194499 or 600744

If anybody has a problem getting on the call, please call 603-271-0670 or email at hilary.ryan@livefree.nh.gov

Comments from the public can be submitted via email to nhreopen@nheconomy.com

For updates on Reopening Task Force Meetings, click here.

There have been updates made to some of the existing guidance documents so be sure to review them for the most up-to-date information.

COVID-19 DASHBOARD

The NH Department of Health and Human Services (NH DHHS) announced the launching of a new COVID-19 dashboard to help residents and stakeholders track the impact of the coronavirus on our communities. This dashboard will be updated daily to provide data on COVID-19 cases, related hospitalizations and deaths with demographic details and county of residence. The goal of the COVID-19 Dashboard project is to make data easy to access.

The COVID-19 Dashboard can be found at:

NH Establishes Online Job Portal

GOFERR Roadmap For Recovery

Governor Sununu announced the Governor's Office for Emergency Relief and Recovery (GOFERR) will be providing $595 million of relief funds from the $1.25 billion federal funds from the CARES act that NH received.

For information on funds and expenditures, visit www.goferr.nh.gov

SBA Business Assistance Programs

TARGETED EIDL ADVANCE

The Small Business Administration is contacting some New Hampshire small business owners about the Targeted Economic Injury Disaster Loan Advance, which provides businesses located in low-income communities with additional funds.

Applicants located in low-income communities who previously received an EIDL Advance for less than $10,000 will have first priority to apply for the Targeted EIDL Advance and will be the first group to receive email invites to the application portal. Those who applied for an EIDL Advance, but did not received funds due to a lack of program funding are in the second priority group.

The SBA will reach out to those who qualify.

Applicants do not need to take any action at this time.

To apply for the Targeted EIDL Advance, you must wait until you receive a direct email invite from the SBA. In accordance with the Economic Aid Act, businesses and nonprofit organizations that received a previous EIDL Advance in an amount less than $10,000 will have first priority to apply for the Targeted EIDL Advance and will be the first group to receive an email invite. You must meet the following eligibility requirements in order to qualify for the Targeted EIDL Advance: 1) business located in a low-income community; 2) suffered greater than 30 percent economic loss; and 3) have 300 or less employees. Please visit our frequently asked questions on www.sba.gov/coronavirusrelief for more details on eligibility.

The SBA will begin sending email invites to businesses and nonprofit organizations that received the EIDL Advance in an amount less than $10,000 starting on February 1, 2021. It may take several weeks before all emails are sent to businesses in the first priority group so please do not be alarmed if you do not receive your email invite right away. The invite to apply will be sent to the primary contact email address associated with your original EIDL application. All communications from SBA will be sent from an official government email with an @sba.gov ending. Please do not send sensitive information via email to any address that does not end in @sba.gov.

Please visit us at www.sba.gov/coronavirusrelief for the latest information and frequently asked questions regarding the Targeted EIDL Advance program. This location is the best source of accurate information for all COVID-19 economic aid programs administered by the SBA.

ECONOMIC INJURY DISASTER LOANS (EIDL) DEADLINE EXTENDED

In response to the Coronavirus (COVID-19) pandemic, small business owners, including agricultural businesses, and nonprofit organizations in all U.S. states, Washington D.C., and territories can apply for an Economic Injury Disaster Loan. The EIDL program is designed to provide economic relief to businesses that are currently experiencing a temporary loss of revenue due to coronavirus (COVID-19).

Economic Injury Disaster Loan (EIDL) applications will now continue to be accepted through December 2021, pending the availability of funds. Loans are offered with a 3.75% interest rate for small businesses and a 2.75% interest rate for nonprofit organizations. To learn how an EIDL loan could be a resource for your small business, visit https://www.sba.gov/funding-programs/disaster-assistance.

PAYCHECK PROTECTION PROGRAM

New borrowers and certain existing PPP borrowers will be able to apply for a First or Second Draw PPP Loan through May 30, 2021.

The Paycheck Protection Program (PPP) provides loans to help businesses keep their workforce employed during the Coronavirus (COVID-19) crisis. SBA is currently offering:

First Draw PPP Loans for first time program participants to businesses keep their workforce employed during the Coronavirus (COVID-19) crisis.

Second Draw PPP Loans The Paycheck Protection Program (PPP) now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP Loan with the same general loan terms as their First Draw PPP Loan. They can be used to help fund payroll costs, including benefits. Funds can also be used to pay for mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations.

A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses,

Has no more than 300 employees; and

Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020

For information on forgiveness, etc., please see the following links:

Interim Final Rule on Loan Forgiveness Requirements and Loan Review Procedures as Amended by Economic Aid Act

PPP Loan Forgiveness Application Form 3508

PPP Loan Forgiveness Application Form 3508EZ

PPP Loan Forgiveness Application Form 3508S

Borrower’s Disclosure of Certain Controlling Interests

Contact your lender, NH SBDC or SBA for assistance.

Seacoast Chamber Alliance Landing Page

The six Seacoast region Chambers of Commerce, including the Hampton Area Chamber of Commerce, Exeter Area Chamber of Commerce, The Chamber Collaborative of Greater Portsmouth, Greater Dover Chamber of Commerce, Greater Rochester Chamber of Commerce, and The Falls Chamber of Commerce, representing over 2,500 businesses, are supporting our business community’s COVID-19 recovery efforts in partnership with the State of New Hampshire. Visit the Chamber Alliance webpage for more information and resources on business recovery.

Employer Resources

Back to Business Resources and Recovery Information

The Greater Rochester Chamber of Commerce has put together a "Back to Business" Resource packet containing relevant information and important resources to help members as they recover from the impact of the COVID-19 (Coronavirus). Click the picture to the left to access the resources packet now.

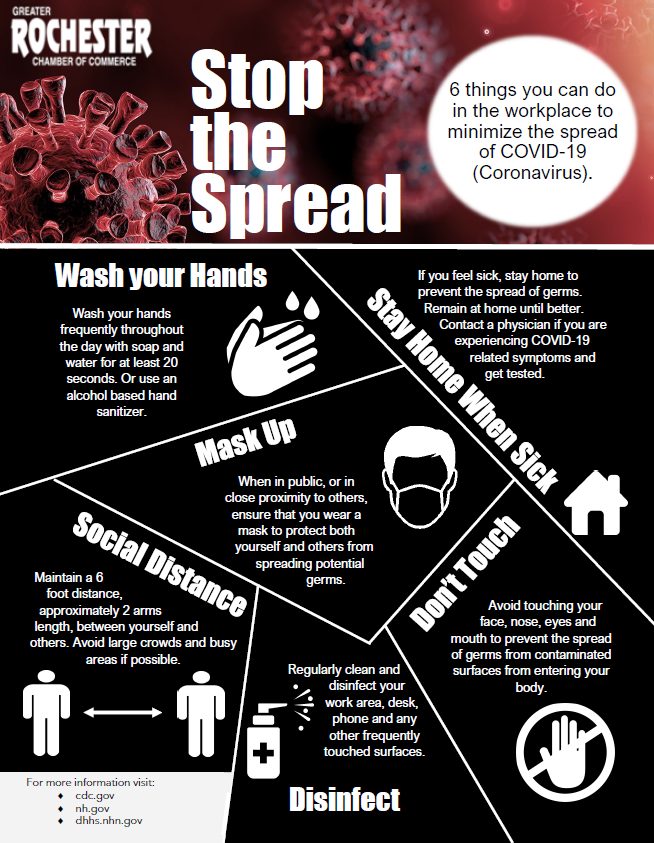

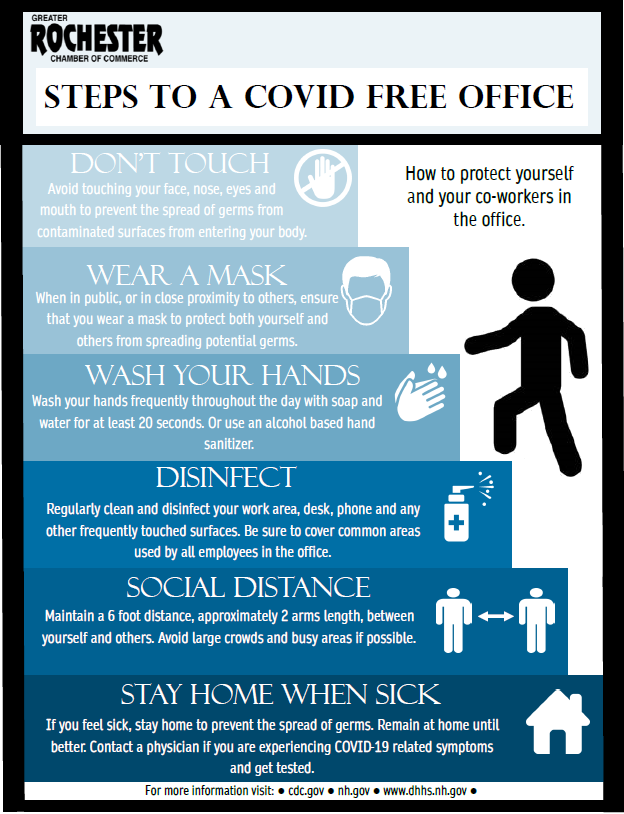

Click the images below for downloadable posters.

NH EMPLOYMENT SECURITY ANNOUNCES WORKSHARE - AN OPPORTUNITY FOR EMPLOYERS

NH Mask Enforcement Guidance

The NH Attorney General's Office has issued guidelines for retail and grocery employees on how to respond to customers who refuse to wear a mask. Retail employees are urged not to engage with the customer after the refusal to wear a mask. Be sure to call your local law enforcement department prior to an issue to establish a plan with them. The guidelines can be read by clicking the button below.

If an Emplyee Tests Positive for COVID-19

The NH Department of Health & Human Services issued new guidance that outlines the five steps an employer should take if their employee tests positive for COVID-19. To learn more and download their guidance document visit:

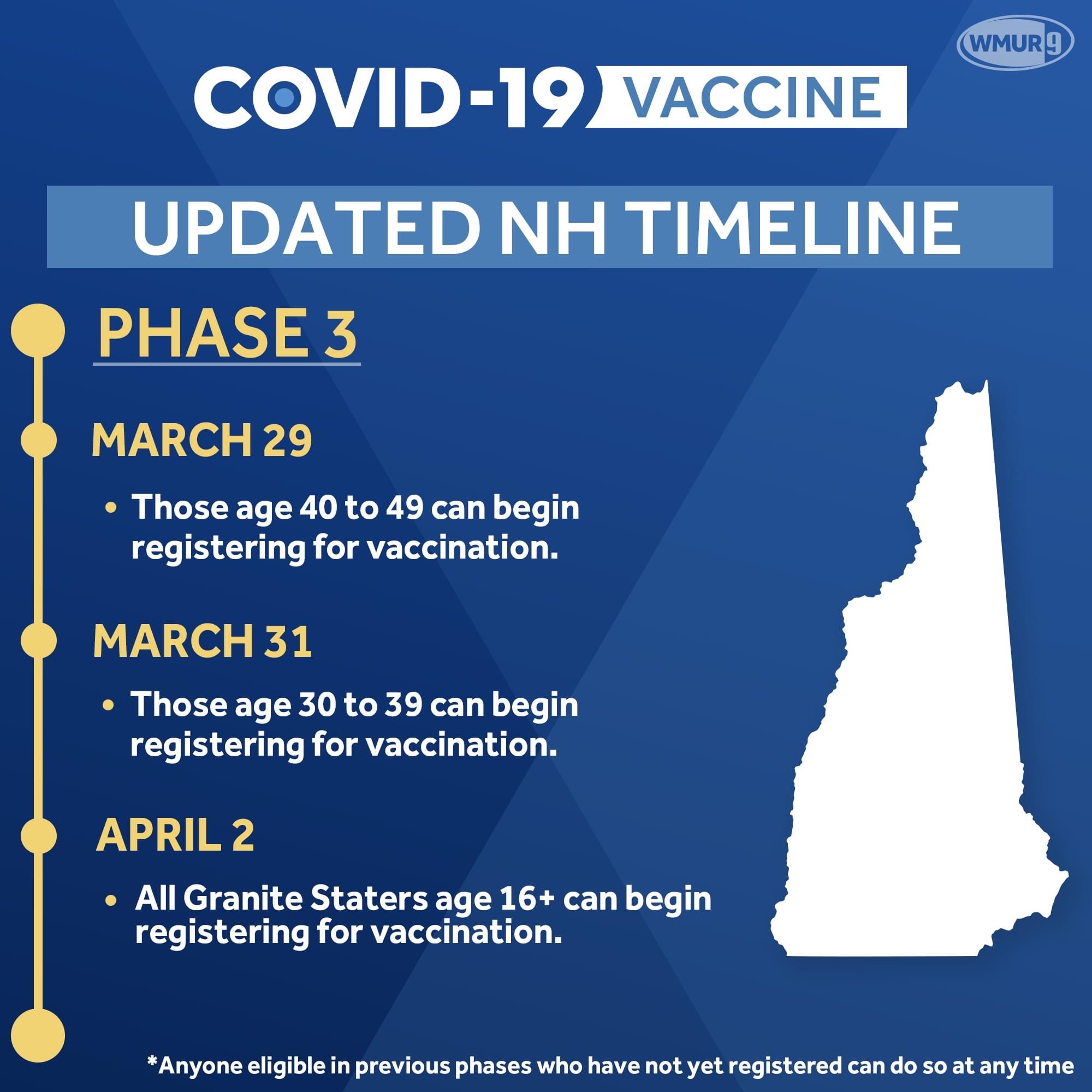

COVID-19 VACCINE UPDATED TIMELINE

Resiliency Academy

NH Small Business Development Center and UNH Extension are partnering to offer Resiliency Academy, bringing together small businesses and community leaders to work toward a resilient future.

Academy sessions will include opportunities to learn from practitioners, municipal staff, business owners, and experts through case studies, presentations, discussions, and Q&A sessions. In addition, Resiliency Academy includes Regional Discussions, Regional Business Cohorts, and the opportunity for businesses to receive advising from SBDC advisors. Participants are encouraged to attend all five sessions.

Who should attend:

- Small businesses, community leaders and volunteers, municipal officials, Chamber Executives, economic development professionals, and those interested in resiliency planning. This academy is designed for NH communities and businesses but is open.

Sessions:

- Each academy session is a 90-minute live session of virtual learning on a particular resilience topic via Zoom. All sessions are held from 9:00 to 11:00 am. Session dates are April 7, 2021, Session 1: Threats; April 21, 2021, Session 2: Assessment; May 5, 2021, Session 3: Visioning; May 19, 2021, Session 4: Planning; and June 2, 2021, Session 5: Action.

For more information and to register, visit https://www.nhsbdc.org/resiliency-academy

Governor Lifts Mask Mandate in NH

Governor Chris Sununu announced that the statewide mask mandate implemented on November 20, 2020 expired on Friday, April 16, 2021.

The announcement follows a reduction in the state’s 7-day average of daily deaths to 0.6, the lowest since October of 2020 before the mask mandate had been implemented, as hospitalizations remain at a manageable level, and as over 70% of those 65+ have been vaccinated. The lifting of the mandate does not diminish the importance of wearing a face mask. The threat to health from COVID-19 is real. Even as restrictions are reduced, we are still in a pandemic and levels of COVID-19 remain high across the State.

New Hampshire State of Emergency Declared

New Hampshire's Stay-At-Home order has expired and a "Safer at Home Advisory" is now in place.

Click on each Emergency Order listed below to access the Executive Order document.

Executive Order 2020-04: An order declaring a state of emergency due to Novel Coronavirus (COVID-19).

Executive Order 2020-05: Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-06: An order establishing the Governor’s Office for Emergency Relief and Recovery and processes and procedures for allocation and expenditure of COVID-19 emergency funds.

Executive Order 2020-07: An order amending Executive Order 2020-06.

Executive Order 2020-08: Second Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-09: Third Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-10: Fourth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-11: An order establishing the New Hampshire Commission on Law Enforcement Accountability, Community, and Transparency.

Executive Order 2020-12: An order directing the formal establishment of the Governor's Youth Advisory Council on Substance Misuse and Prevention (GY AC).

Executive Order 2020-13: An order amending Executive Order 2020-11.

Executive Order 2020-14: Fifth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-15: Sixth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-16: Seventh Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-17: Eighth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-18: Ninth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-19: An order regarding implementation of recommendations of the New Hampshire Commission on Law Enforcement Accountability, Community, and Transparency.

Executive Order 2020-20: Tenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-21: Eleventh Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-22: An Order Establishing the Council on Housing Stability.

Executive Order 2020-23: Twelfth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-24: Thirteenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2020-25: Fourteenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2021-01: Fifteenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2021-02: Sixteenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2021-04: Seventeenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2021-05: Eighteenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2021-06: Nineteenth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2021-08: Twentieth Extension of State of Emergency Declared in Executive Order 2020-04.

Executive Order 2021-10: Twenty-first Extension of State of Emergency Declared in Executive Order 2020-04.

- Temporary remote instruction and support for public K-12 school districts.

Emergency Order #2:

- Gatherings of 50 people or more are prohibited. Restriction of food and beverage sales to carry-out, delivery, curbside pick up or drive through only.

Emergency Order #3:

- Prohibition of discontinuation of essential services including electricity, gas, water, telephone, cable and internet, through the duration of the State of Emergency.

- Eversource has committed to this order, and has useful information for their customers and the community. Visit their website here.

Emergency Order #4:

- Prohibition of issuance or enforcement of eviction notices for the duration of the emergency.

Emergency Order #5:

- Suspends the one week waiting period for those filing for unemployment benefits.

- All claims and questions should be directed to NHES.NH.GOV or call the Unemployment Assistance Hotline at (603)271-7700.

Emergency Order #6:

- Temporary authorization of take-out or delivery of beer or wine.

Emergency Order #7:

- Temporary modification of data and privacy governance plans.

Emergency Order #8:

- Temporary expansion of access to Telehealth Services to protect the public and health care providers.

Emergency Order #9:

- Establishes the COVID-19 Emergency Healthcare System Relief Fund, a $50 million fund for hospitals and health care providers in the state which will provide short-term, no interest loans.

Emergency Order #10:

- Requires all sellers of groceries to temporarily transition to use of single use paper or plastic bags.

- Temporary authority to perform secure remote online notarization.

- Temporary modification of public access to meetings under RSA 91-A.

- Temporary allowance for New Hampshire pharmacists and pharmacies to compound and sell hand sanitizer over the counter ("OTC") and to allow pharmacy technicians to perform non-dispensing tasks remotely.

- Temporary authorization for out-of-state pharmacies to act as a licensed mail-order facility within the State of New Hampshire.

- Temporary authorization for out of state medical providers to provide medically necessary services and provide services through telehealth.

- Temporary prohibition of scheduled gatherings of 10 or more attendees.

- Closure of non-essential businesses and requirig Granite Staters to stay at home.

- Temporary modification to Department of Safety Laws and Regulations.

- Extension of Remote Instruction and Support for Public K-12 Schools.

- Temporary emergency wage enhancement for New Hampshire Liquor Commission retail employees.

- Establishment of the COVID-19 Emergency Domestic and Sexual Violence Services Relief Fund.

- Authorization of emergency funding for child protection services.

- Temporary modification of municipal and local government statutory requirements.

- Modification and clarification of Emergency Order #4.

- Temporary modification of interest penalty for late payment of property taxes.

- Extension of Emergency Orders 2, 6, and 16.

- Restriction of hotels and other lodging providers to provision of lodging for vulnerable populations and essential workers.

- Temporary non-congregate sheltering order to reduce the spread of COVID-19.

- Temporary modification to executive branch deadlines and requirements.

- Temporary requirements regarding healthcare provided in alternate settings.

- Establishment of the COVID-19 Long Term Care Stabilization Program.

- Extension of Emergency Orders #1 and #19 (temporary remote instruction and support for public K-12 school districts).

- Activation of the New Hampshire Crisis Standards of Care Plan.

- Further temporary requirements regarding health insurer coverage of health care services related to the coronavirus.

- An order temporarily waiving the 28-day separation period before a retired public employee can return to work on a part-time basis.

- Ensuring Worker's Compensation coverage of New Hampshire first responders exposed to COVID-19.

- An order relative to Executive Branch hiring and out-of-state travel.

- Temporary modification of school board and district statutory requirements.

- Temporary allowance for agents to consent to clinical trials.

- Extending and modifying Emergency Order #17 (Closure of non-essential businesses and requiring Granite Staters to stay at home).

- Additional Medicaid Eligibility for Uninsured.

- Authorizing temporary health partners to assist in responding to the COVID-19 in long-term care facilities.

- Temporary modification to requirements for change of party affiliation.

- Pursuant to Executive Order 2020-04 as Extended by Executive Orders 2020-05, 2020-08 and 2020-09 PDF file - Modification of Emergency Order #9 (Establishment of the COVID-19 Emergency Healthcare System Relief Fund)

- Pursuant to Executive Order 2020-04 as Extended by Executive Orders 2020-05, 2020-08 and 2020-09 PDF file - Modification of Emergency Order #31 (Establishment of the COVID-19 Long Term Care Stabilization Program)

- Further expanding access to medical providers.

- Expanding access to COVID-19 testing via licensed pharmacists.

- Special Education Requirements to Support Remote Instruction.

- Extending and Modifying Emergency Order #17 (Closure of non-essential businesses and requiring Granite Staters to stay at home)

- Temporary modification of travel expense allowance for members of the General Court

- An order terminating Emergency Orders #4 and #24.

- An order regarding public health guidance for business operations and advising Granite Staters that they are safer at home.

- Amendment to Emergency Order #36 (Ensuring Worker's Compensation Coverage for New Hampshire First Responders Exposed to COVID-19).

- An Order Regarding Refunds of Road Tolls to Private School Bus Owners for Transportation of Meals to Students During the COVID-19 Pandemic.

- Extension of COVID-19 Long Term Care Stabilization Program.

- Temporary Modification of Procedure Relative to Appropriations and Tax Payments.

- Temporary emergency wage enhancement for certain employees of the New Hampshire Department of Natural and Cultural Resources, Division of Parks and Recreation.

- An Order Terminating Emergency Order #3.

- Temporary Modification of Health and Human Services Rules and Statutes Regarding MEAD Premium and Signature Requirements.

- Termination of Emergency Order #10.

- Extending Emergency Order #52.

- An order protecting pre-existing non-conforming use status for summer camps unable to operate due to COVID-19 during the summer of 2020.

- An order requiring face coverings for certain scheduled gatherings of 100 or more individuals, as part of the state's efforts to respond to COVID-19.

- Temporary Remote Instruction and Support and Hybrid Instruction for K-12 School Districts.

- An order authorizing assessments of civil penalties against businesses, organizations, entities, property owners, facility owners, organizers, and individuals who violate emergency orders.

- An order extending Emergency Order #52.

- Establishing the Remote Learning Center Verification Program.

- Unemployment compensation changes to broaden eligibility.

- Ethics Committee for Crisis Standards of Care Clinical Guidelines.

- An order extending Emergency Order #52.

- Temporary Suspension of Penalty for Failure to File Financial Report Pursuant to RSA 198:4-f.

- Travel Guidance and Extension of Emergency Order #52.

- Reactivation of the COVID-19 Long Term Care Stabilization Program.

- An order requiring persons to wear masks or cloth face coverings when in public spaces without physical distancing.

- An order authorizing certain nursing students to obtain temporary licensure.

- Suspension of certain provisions of RSA 141-C:20-f and NH Administrative Rule He-P 307 to comply with CDC requirements for vaccine data.

- An order amending and restating Emergency Order #37.

- An Order Authorizing Certain Military Service Members and Emergency Medical Technicians to Obtain Temporary Licensure as a Licensed Nursing Assistant.

- An order allowing registered and certified pharmacy technicians to administer COVID-19 vaccines under certain conditions.

- Medicaid Disaster Relief for the COVID-19 National Emergency, COVID-19 Vaccine Administration.

- Extension of Emergency Order #74.

- Travel Guidance and Extension of Emergency Order #52.

- Temporary provisions to respond to timing challenges related to the enactment of Senate Bill 2 in the 2021 Legislative Session.

- Rescinding Emergency Orders #37 and #77, lifting the State of New Hampshire's hiring freeze.

- Schools to offer in-person instruction to all students at least two days a week starting March 8, 2020.

- Authorizing certain retired healthcare workers to administer the COVID-19 vaccine.

- Extension of Emergency Order #74.

- An order regarding travel guidance and extending Emergency Order #52.

- Second Amendment and Restatement of Emergency Order #64.

- Extending Emergency Order #52.

Federal Funding Programs and Resources

OTHER

ASSISTANCE

PROGRAMS

NH Charitable Foundation Community Crisis Action Fund

The New Hampshire Charitable Foundation has announced a Community Crisis Action Fund, that provides grants to nonprofits who are working to reduce the impact of COVID-19, such as food for children and seniors, shelter for homeless and families, and transportation. Grants will also help longer-term needs like health care, emergency response, childcare, and food security. Additional grants will be used to support local emergency funds.

Center for Disease Control (CDC)

Click here for the latest updates on COVID-19.

Also see the attached informational piece on Keeping the Workplace Safe, provided by the CDC.

Announcements from NH DMV

- DMV transactions are only being processed through our drop box services, online, through the mail or by appointment.

- Please visit the DMV's Appointments and Services page for directions on completing your specific transaction.Other important information:

- In-person driver license appointments are currently only available for licenses that are expired or are expiring by November 30, 2020. Customers are encouraged to renew online, if eligible.

- REAL ID compliance deadline has been extended until October, 2021. REAL ID transactions are not currently conducted outside of renewal transactions.

- All motor vehicle related hearings will be held by video or phone conference. Please email safety-hearings@dos.nh.gov to provide an email and phone number to facilitate scheduling.

Employee Protection Tax Credit

Employee Retention Tax Credit Program

This program is designed to help businesses that are closed or partially closed due to the crisis or have experienced greater than 50% in quarterly revenue losses. Note – employers who receive a PPP loan are not eligible for this tax credit. The US Chamber of Commerce has produced a useful infographic on the program. Additional details are provided in the attached business resources and on the IRS website: https://www.irs.gov/coronavirus

NH Providing COVID-19 Testing

Most health insurance plans cover tests for COVID-19 without a copay, coinsurance, or deductible.

Many locations throughout the state including hospitals, pharmacies, primary care offices, urgent care

centers and many other locations offer COVID-19 tests. Tests for active COVID-19 disease are available

in locations across New Hampshire and include both the polymerase chain reaction (PCR) test and the

rapid antigen test. The PCR test is for persons with or without symptoms of COVID-19. The rapid

antigen test is for persons with symptoms and within a specific timeframe after onset of symptoms.

Persons who do not have insurance or have a health insurance plan that does not fully cover the cost of

tests may have access to pay for testing via a New Hampshire Limited COVID-19 Testing Benefit. To

apply online for the Testing Benefit, please visit NH EASY at https://nheasy.nh.gov and click on “COVID19 Testing”. Additional information about other DHHS programs and benefits, including different

Medicaid plans that cover more than COVID-19 testing services, are on the NH EASY website.

Masks available for purchase at NH State Liquor Stores

Governor makes masks available at NH State Liquor Stores for businesses at cost.

Tips for Small Businesses

Beware of Cyber-threats and Scams (See attached)

There is a fast rise in fake CDC emails, phishing emails related to charity and fake vaccines, and counterfeit PPE. Please be extra diligent and report anything suspicious to the FBI’s Internet Crime Complaint Center at www.ic3.gov and to the State of NH Dept of Justice Consumer Protection Bureau via email DOJ-CPB@doj.nh.gov.

Stay home if...

Encourage your employees to stay home if they, or someone in their household is feeling sick.

Handle food carefully

Limit food sharing. Strengthen health screening for cafeteria staff and their close contacts. Ensure cafeteria staff and their close contacts practice strict hygiene.

Practice good hygiene

Stop handshaking - use other non-contact methods of greeting. Clean hands at the door and schedule regular hand washing reminders by email. Create habits and reminders to avoid touching faces and cover coughs and sneezes. Disinfect surfaces like doorknobs, tables, desks, and handrails regularly. Increase ventilation by opening windows or adjusting air conditioning.

Be careful with meetings & travel

Use videoconferencing for meetings when possible. When not possible, hold meetings in open, well-ventilated spaces. Consider adjusting or postponing large meetings or gatherings. Assess the risks of business travel.

If you have any questions please call (603)225-1400 or email NewHampshire_DO@sba.gov.

Other Helpful Links

USDA Rural Development:

Click here to see more about...